Insurance & Access fee at Rebel Med NW's

Integrative Concierge Clinic

Access Non-Covered Service/Concierge Fee

Our Concierge fee charged each insurance based visit goes towards the the extra time our providers spend during care visits to support your medical care, 2 week post visit time for answering any questions or support of a previously discussed care concerns, and supports the aspects of care we provide that insurance does not cover as a naturopathic physician including more time dedicated towards prevention, wellness, nutrition, & coaching.

While this may be new, it does allow us to stay in-network with some of the insurances that still provide adequate reimbursement for the covered services we provide for disease evaluation while still aiding our ability to support health optimization and wellness. This non-covered concierge fee is in addition to any patient responsibility for services or care. This fee is absorbed into the final cost of a visit if insurance denies benefits for any service or determines that a service is not medically necessary per their benefit plan. We will additional adjust the visit to our direct pricing rate for all patients equally when insurance denies care.

Naturopathic Insurance based care:

A Concierge fee of $25 per 30 minute appointment is charged. Initial visits, prolonged visits and annual exams are $50 when a visit is over 30 minutes. This also allows us to take additional time before, during and after your visit to support your care through our functional medicine, research, and post care management support.

Acupuncture Insurance based care:

A Concierge fee of $25 is charged per visit, and and additional $25 is charged for EAMP services, this includes manual therapy/cupping/bodywork, therapeutic education, dietary education, breath work and is not covered by insurance.

Insurance companies and plans vary widely and change with little notice. We encourage our patients to call their insurance providers for detailed coverage benefits at our office.

Not all services at our office are deemed “medically necessary” in the eyes of insurance companies. We are considered “in-network” with insurance to augment care and accessibility to our medicine, but the level of patient responsibility (copay/coinsurance/deductible) per services will vary.

If you do not see your insurance provider listed below then they may be considered “Out-Of-Network”. Please contact us if unsure. The patient will pay our self-pay pricing at the time of service and we can provide a detailed superbill that you can submit to your insurance for out of network reimbursement. For example, the First Choice Network has been closed to acupuncturists for several years, but they offer out-of-network reimbursement for our providers.

List of Insurances our Naturopathic Doctors are In-Network with

Naturopathic providers are considered in network with the following insurances, however your individual plan may exclude Naturopathic coverage:

-

- LNI (Labor & Industry work injury) – Dr. Andrew Simon

- Blue Cross Blue Shield (BCBS) – Naturopathic coverage varies by state, please call to confirm. – All ND Providers

- Regence Blue Shield / Uniform/ – Naturopathic coverage varies by state, please call to confirm. – All ND Providers

- Premera Blue Cross / Anthem – Naturopathic coverage varies by state, please call to confirm. – All ND Providers

- First Choice / First Health Network

- Kaiser PPO ONLY (not CORE/HMO) (will have First Choice/First Health on the insurance card, we are not in-network with Kaiser Core/HMO) – All ND Providers

- Molina Marketplace & Medicaid (As of 2025 we will end no longer accept Molina Apple Health, email us for our sliding scale rate and low income membership)

- Aetna – Dr. Andrew Simon Only

- Other ND Providers out of network

- Kaiser PPO (not associated with First Choice) – Dr. Andrew Simon

- Coordinated Care (Ambetter exchange plan, not Apple Health)- Dr. Andrew Simon

- Cigna/ASHLink – All providers (Does not cover Spinal manipulation)

- Motor Vehicle Accident(MVA) /Personal Injury Protection(PIP) – All providers

- Please also account for the $25-75 non-covered services that are provided during our Naturopathic Procedure visits if there is a service not covered by insurance.

List of Insurances our Acupuncture Providers are In-Network with

Acupuncture providers will be in network with the following insurances:

-

- No LNI offered at this time.

- Regence Blue Shield / Uniform / RGA – Acupuncture coverage varies by state, please call to confirm.

- Premera Blue Cross / Anthem – Acupuncture coverage varies by state, please call to confirm.

- Blue Cross Blue Shield (BCBS) – Acupuncture coverage varies by state, please call to confirm

- Aetna – Khai & Phonexay

- Kaiser PPO (NOT CORE/HMO) – Phonexay

- Coordinated Care – Phonexay

- MVA/PIP – Khai and Phonexay

- Please also account for the $25-75 non-covered services that are provided during our acupuncture visits.

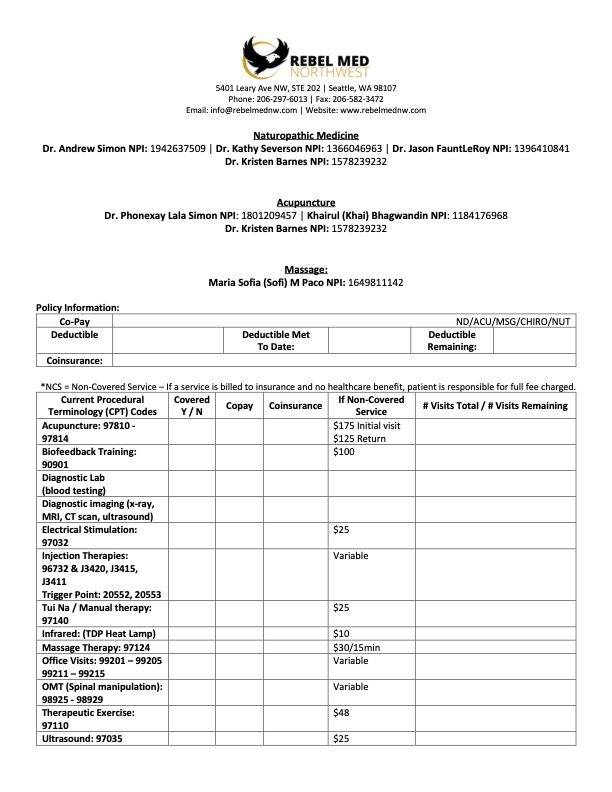

This worksheet is a guideline and tool for your use to understand your insurance benefits. It is a comprehensive document for you to learn from your insurance provider about your specific plan and how it may be applied at our office. You can use as much or as little of it as you would like.

Some ways to complete this worksheet:

- ONLINE: Log into your personal account for your Individual Insurance Plan. You should be able to find much the information you need within that database.

- DOCUMENTS: Some plans come with a Benefits Package Document that lists your Insurance Benefits, you may also use that document to complete this worksheet. This document may have been given to you when you signed up for your insurance plan, or you may need to log into your personal plan account (see item 1).

- CALL: Whatever information you find missing after that, you can choose to contact your insurance representative directly.